Morning folks and welcome to Sunday CET.

Today’s email is about the British pension scheme, shitloads of un-used money in the market and Revolut vs. Klarna as investments. And more - as always, hit reply and let me know your thoughts and comments.

Dragos

In-depth intel you won’t find elsewhere

Nordic 9 is the best way to get familiar fast and stay updated with who’s who in the Euro VC land.

The startup deals and investors database are assorted with a library of hundreds of cheat sheets + weekly intel covering verticals, geographies and whatnot from the European startup world.

👇 Subscribe now 👇

Market talk

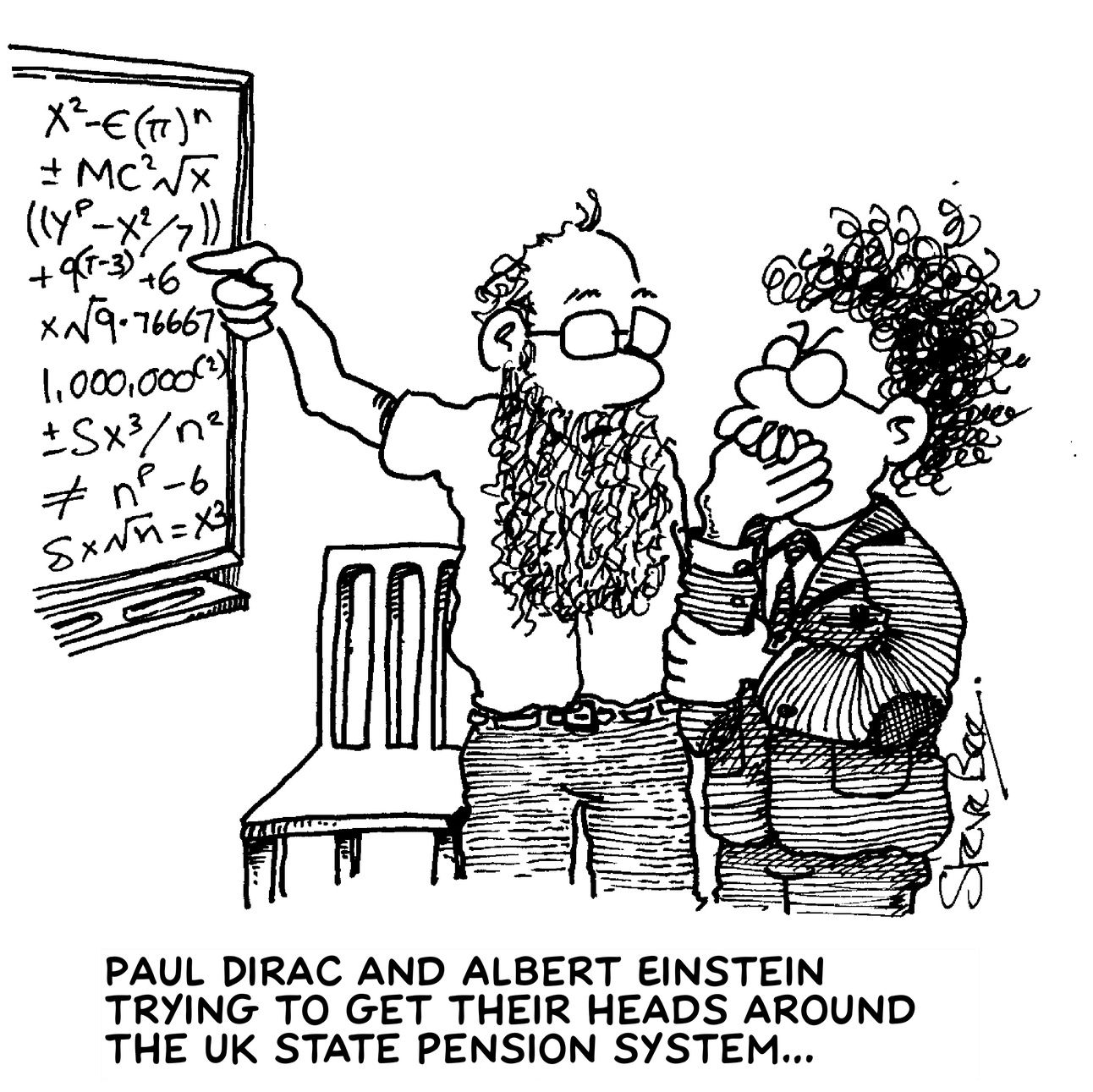

🇬🇧 What if the Brits are doing the unthinkable and unlock the IPO market by reforming drastically the pension scheme?

stop laughing. A long shot, I know, writing about VC-backed startups doing IPO in Europe, or London for that matter, is just beating a dead horse - nobody is taking it seriously.

but change doesn’t happen over night - it comes gradually and then all of a sudden.

for example, earlier last month, Britain's markets watchdog eased up the conditions for listing on the local stock exchange.

this week, UK chancellor Reeves travelled all the way to Canada to meet the heads of big pension schemes in Toronto - she says a Canada-style pension model would fit the UK in order to put the money into equities and infrastructure.

if there’s a will, there is a way, the saying goes…

fwiw, the pension money is worth £360 billion and is currently fragmented into 86 individual funds across the UK - changing the system would require aggregating the management of those funds, one way or another.

but this is mostly a political decision involving taking local budgets from local politicians - that never works well and requires big compromises, at best. Add to that stripping £1 billion in annual fees currently paid to all sorts of beneficiaries of an as is fractured system - i.e. lawyers, asset managers, banks, actuaries.

it’s a whole economy built on top of it - in other words, a paradigm change would involve many parties to lose huge amounts of money they make out of the current one.

that’s just the surface of it and what it’d take at minimum for the Brits to make it work - if they succeed though, it’d provide a much needed liquidity for fixing one side of the public markets.

how likely is that to happen though? Hard to tell but usually when there’s murky political context, figure what is at the other side of the stick - cui bono?

it’s somehow a similar context to what happened with Brexit - it’s not that over night Cameron decided he wanted to give the Brits their dignity back, it’s that a group of local businesses were to make more money if Brexit happened. And so it did and the country’s been in disarray ever since.

Apple pushed new changes in its App Store ops and fee structures that should be in DMA compliance required by the EU.

the Americans stuck to their defiance positioning of aligning to what the law asks of them by making its App Store as complex and confusing as possible for both customers and developers based in Europe.

Spotify and Epic were quick to call the changes malicious compliance.

the ball is now in the EU’s court - this is far from over, a lengthy battle that the EU simply cannot win. Money talks, Apple is better equipped and the EU is driven more by ego than reason, in spite of having the legal means to enforce whatever it wants.

🇪🇺 Speaking of which - we’re at peak EU breaking up dealing with the local tech market.

one of the makers of the EU legislation says ‘we’re not only bad at our jobs, but also know that we suck and everybody else pays the consequences for that.’ (I am paraphrasing - the original here)

💲 Klarna joins Revolut as is reportedly planning a secondary deal that should take the temperature of the investment community for a would-be IPO event.

but while Revolut is growing like crazy, grabbing market share left and right, Klarna has been focusing on cost cutting and profitability, boasting that it saved money by using AI software in customer support - that’s like finally figuring they could upgrade from Nokias to iPhones, but I digress.

so one is a growth story while the other is a profitability one, what do you think investors favor if they had to choose?

fwiw, Klarna last raised money at a $6.7 billion valuation back in 2022, a dramatic drop from $45bn+ a year before caused by the poor management under the ZIRP period.

💲 Seven of the biggest publicly traded alternative asset managers have had more than a half-trillion dollar in dry powder as of June 30, a 9% yoy increase.

$722 billion to be exact. Conventional thinking says that’s a lot of fresh powder and money gotta be put to work and deployed for deals, right?

otoh, Warren Buffet’s Berkshire cash position alone reached some 277 billion at the end of July, 80 billion more than it was at the end of May.

that’s a lot of dough building into a super defensive position, requiring high management fees for just managing t-bills.

why are professional investors sitting on cash? Are those guys just underinvested and all this cash chunk is just a coincidence, or, maybe, a sign of an upcoming set of events such as markets crash, US elections, WW3 etc?

macro is bad but not that bad, and can easily make for a bull and a bear path altogether, depending on the mood you wake up in the morning - I know investors on both side of the spectrum.

even this Monday’s blip in Japan was followed by a textbook Turnaround Tuesday - it seems like we’re on an equilibrium, fragile yet holding.

what do you guys think?

😱 Elon Musk has really lost the plot.

I mean, it’s cool that he found investors to give him 45 billion to buy a media asset which he then transformed into a platform encouraging all sorts of idiots propagate conspiracy theories - that is pushing the freedom of speech to its stricto sensu meaning, after all, if only we’re to be purist and think he is in good faith.

but why on Earth would Elon Musk himself spend time to propagate all those conspiracy theories and go to war with the British government and even the PM? You’d think, just like me, that a guy who founded a rocket company and an EV manufacturer can do better than that.

to put sugar on top, this week he also went to war with his own customers, whom he sued because they, uhm, don’t want to be his customers anymore - this is also a good summary bit.

I have no reasonable answer as to why all these but not bad for a week’s work.

.

Also notable

🇪🇺 Cheat sheets

European defence tech that just raised money.

what startups American investors backed in Europe in the first half of 2024.

🇮🇹 Italy doubled the billionaires' flat tax to €200k per year, applied on income earned abroad by wealthy individuals who transfer their tax residence to the country.

1,186 super-rich individuals had transferred their residency for tax purposes to Italy since 2017.

💲 This week, Mubadala had a story pushed to the media saying it’s actively involved in restructuring European startup investments which were badly managed after having raised shitloads of ZIRP money.

this comes as, or perhaps because, Mubadala’s London boss is moving to the US, after eight years spent in the UK.

🇫🇷 The French boasting their startup ecosystem as European best and comparable to Silicon Valley. They’ve come a long way and sit on a lot of governmental money, no doubt, but that’s also a lot of kool aid, nobody moves to France other than Americans to write home that Paris is kewl. Right? 🫠

🇺🇸 YC is adding a third batch this year - the YC Fall Batch

👓 Techstars is doing another round of laying offs, as it’s ending its J.P. Morgan-backed programs

🇯🇵 SoftBank announced plans to buy back up to $3.4 billion in stock, or 6.8% of its outstanding shares.

✍️ Food for thought:

✨ People are running away from VC jobs - oh wait, whatever happened with the glam?

🤯 Politicized scientists lose credibility on Twitter.

🏟️ A visual guide to the history and story of the Olympic Games.

💲 It’s good to be Snoop Dogg - he makes $500,000 a day plus expenses for his coverage of the Olympics.

🐕 Dolce & Gabbana launches luxury perfume for dogs.

🍲 What do they serve at a restaurant in the Arctics?

🗣️ % of the population that speaks fluent English.

That’s all folks, have a wonderful week!

Did you find this email useful?

Thanks for reading! Please send me feedback by hitting reply.

To support my work, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.4