Good morning from a snowy New York, where it’s never too early for kids and dogs to play happy together in the fresh snow of the Central Park.

Welcome to Sunday CET, people! This week, fittingly as I am still in the US, we look at the need of European startups to have an American strategy as soon as possible - or their investors for that matter. And a lot more, this edition is packed.

As always, ping me with comments and feedback, let’s make this a conversation. Thanks for reading!

In-depth intel you won’t find elsewhere

Nordic 9 is the best way to get familiar fast and stay updated with who’s who in the Euro VC land.

The startup deals and investors database are assorted with a library of hundreds of cheat sheets + weekly intel covering verticals, geographies and whatnot from the European startup world.

👇 Subscribe now 👇

Market talk

Europeans at YC this winter

Ever since I have built Nordic 9, it’s a tradition for me to keep an eye on the European startups part of YC. Had a quick look this morning, and have some thoughts too:

doing this as YC is a highly selective program, and the more ambitious Europeans see it as either a bridge or a catapult to find competent investors and sales leads for building straight from US, a much fertile startup ground than Europe.

YC is the only early stage investor that has no people in Europe at all and yet attracts the best startup founders every year. Pull not push levers.

this not only commends an ulterior premium most early stage investors cannot or are not willing to pay but also it allows YC to have an index-like approach for the top 1-5%, while employing people to provide value add to the startup founders in the program - content marketing, as some VCs would call it.

but it’s more than content mkting, as YC’s tech backend as well as the free and internal tools are hardly used for sales but rather as value add for post sourcing - more value add than most investors are able to provide - complemented by a large community network of possible early customers and hires.

that is why it’s also difficult to copy Y Combinator - clones usually chase building one pillar (i.e. mentorship) of an already solid tech-driven foundation that’s wrapped up in a great no-asshole DNA. Which DNA, again, is super important and a differentiator for any company.

anyways - just stating the obvious here, you guys already knew that.

this spring’s demo day is in early April and from what I am gathering, the current Euro batch is seemingly an Anglo-French affair, assorted with three Swedish startups. No other countries are represented.

it is an all time high for Swedes too - Leya, Superagent and Vectorview, in case you were wondering.

not surprisingly, all of the Europeans are AI startups. All of them. By default they sell themselves as we’re an AI that solves X, whereas X is the business they’re in. And that said business should have a sizeable opportunity attached to it, at least in theory.

however, most of them are seemingly generic development tools (or features) using AI for small angles of attacking the enterprise market - smart insights with a hard business case.

are those attack angles good enough entry points in order to make a dent in a super competitive market? Are they defensible? Mere iterations or disruptions? What is it that you bring as a smart developer from Europe in order to build fast an American customer base?

those are the hard questions to answer, and those are the lens any serious investors would use for committing funds.

otoh, those startups sell themselves as AI first because this is what the investors are buying today - not saying they’re doing AI would put them at disadvantage.

but I also think investors finally got the idea that AI is just a tool and not the holy grail that will instantly turn into a fund returner, which is the open secret dream of this industry. That means it’s harder to sell them undifferentiated AI toys without a solid business case.

back to this winter batch, very few, if any, are vertical apps

Konstructly, for example, does SAAS payments in a management app for construction companies.

Solve Intelligence does an in-browser document editor for patent attorneys.

Model AI does AI due diligence for investors (which by now any respectable investor should have it in-house already. Right? :D)

was expecting more from the French, probably because there should be some substance to all the hype and shitloads of money investors throw in Paris for AI these days.

in the program this year we’ve got from France a customer chatbot on top of whatsapp, an LLM analytics tool, AI for sales and two data aggregators.

if this is last fall’s AI best from France, color me skeptical.

as always, you can find the whole list over at Nordic9.

The most valuable series A of Europe - 2023

This week I wanted to take the pulse of what series A dealers have spent on in Europe last year - we have tracked about 850 deals for startups that raised between 10 and 50 million in Europe in 2023.

however, there’s also a number of $50M+ series A deals closed in 2023 - not too many, a dozen or so.

Mistral is by far in the top of the list of the largest ones, with almost half a billion raised in VC funding for a mere series A - money includes debt though. Reminder: the seed was 113 million - stakes are high and understandably so, Mistral is Europe’s (and France) hope to count in the big boys game doing general LLMs.

the crown’s jewel, right? As a side note, those European hopes are mostly fuelled by American capital. If they weren’t, those investors would be bad at their job.

in the first part of the year, another Swedish startup stood out with a $65M series A led by Lakestar. That’s notably Daniel Ek’s other startup, a reason for investors paying a hefty premium, Daniel is probably one of the more successful tech entrepreneurs Europe has ever produced.

other interesting expensive series A names from the first part of the year include The Exploration Company from Germany, Flowx from Romania, Oxford Ionics from the UK or ClearSpace from Switzerland.

we have screened all the transactions and made a selection of interesting A-series ones, available as cheat sheets:

Other cheat sheets:

active angels and interesting angel deals in Europe

European hot startups lists

Deal highlights from this week

🇳🇴 Ciloo, developing a B2B marketplace helping eCommerce companies with access to on-demand local production, raised $1.3 million in a pre-seed round led by Alliance Ventures joined by angel investors in Norway.

🇸🇪 Fever, doing a smart grid platform that automates and optimizes the bidding and market participation for companies' energy assets, raised $11 million in a seed funding round led by General Catalyst, with participation from La Famiglia and Norrsken VC.

🇬🇧 Magic dev, building a superhuman (i.e. AI) software engineer, raised $117 million in a series B led by Nat Friedman & Daniel Gross, with participation from CapitalG and Elad Gil.

All this and much more straight to your inbox alongside access to a comprehensive database, if you subscribe to access our work covering European intel.

It’s the best early stage intel you will find in Europe.

Also notable

🇪🇺 Some European entrepreneurs believe there will be less deal activity, as we’re witnessing reduced exit routes from their business on the continent.

the elephant in the room: if Amazon can’t buy a maker of vacuum cleaners, it sends a signal that it will be difficult for Big Tech to buy anything at all

if big American tech can’t buy companies and the local public markets are a joke, what’s the actual exit strategy for private investors and the EU money altogether?

I can only think of one - move to the US. It’s not that the Americans have money, Europeans have either - it’s that Americans know better how to make more money fast.

How much better? Here’s DB’s take on the matter:

The venture capital market in the EU is significantly smaller than in the US, where $246 bn of VC has been invested in 2022. As a consequence, it is more difficult for young European firms to scale up compared to their US peers. They often depend on non-European investors for larger funding rounds. This heightens the risk of European startup companies relocating abroad.

Less favourable exit environment in the EU than in the US. US stock exchanges boast a market cap which is almost 3 times as large as that of all European stock markets combined. Hence, many exit routes lie outside the EU. Two out of three IPOs of startups backed by European VC firms happened on non-EU exchanges in 2023.

To grow further, VC in the EU not only needs to overcome the current market slump, but also address structural issues: (1) attract more funds for risk capital investments, (2) scale up VC investments, (3) overcome market fragmentation, (4) improve exit options within the EU.

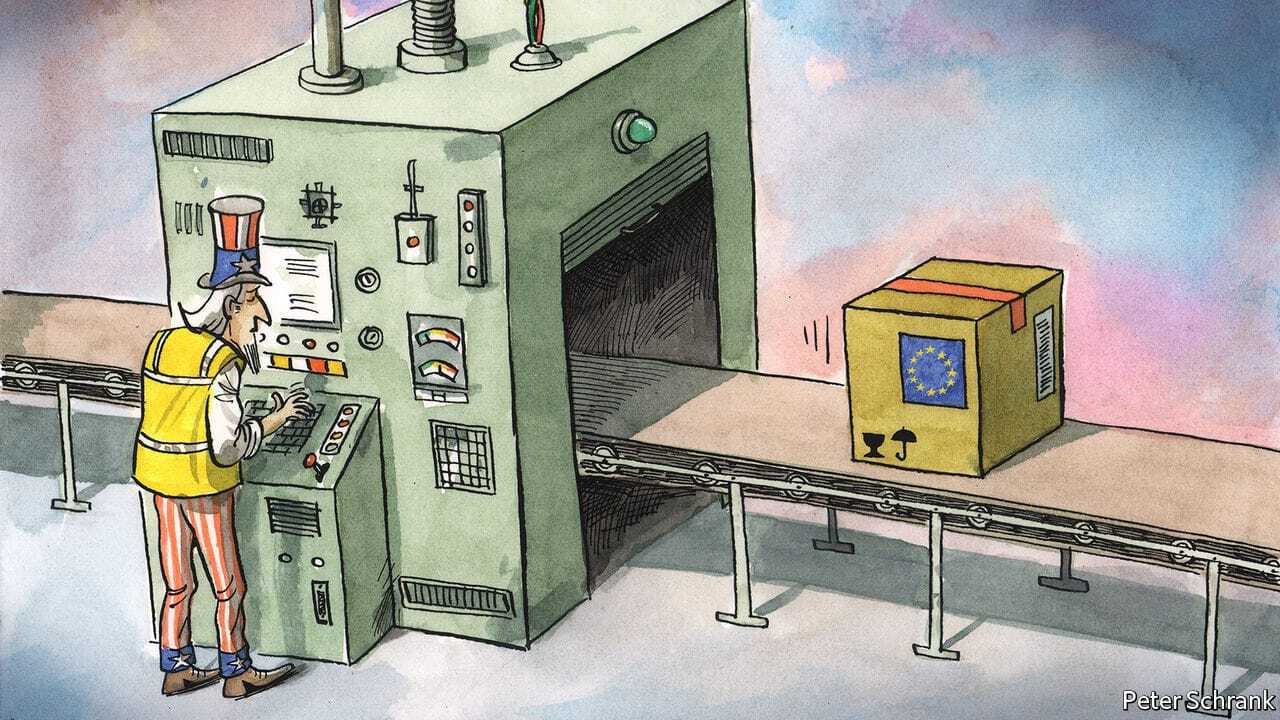

If you’re a startup raising money from VCs in Europe, top question to ask them should be “how do you help me to get the the US market as soon as possible?”.

the smart ones already have processes and networks in place. And if they don’t have a good answer…

related: real talk on funding gaps.

🇪🇺 Here’s another twisted case of Europe allowing too much competition that is detrimental to a whole industry - the telecom.

Telecom Italia CEO Pietro Labriola says that Europe has too many phone carriers, especially compared with the US

nothing new, it’s a long standing problem - the law prevents consolidation that in turn would make it easier for investments and deployments of 5G networks, which is a big task for small players. Meaning they don’t have the muscles to do it.

there’s some 50 mobile operators and more than 100 fixed operators in the European Union

in the US, mobile connectivity to pretty much all of the country is handled by Verizon, T-Mobile, and AT&T.

in China, people can choose between three different carriers, all of which are owned by the federal government.

💲 Siemens raised €15.8 billion in debt in what is Europe’s largest corporate bond offering in a year.

🇺🇸 Been preaching the heat pump sector for a year now - in US, nine states are basically begging you to get a heat pump.

they signed a memorandum of understanding that says that heat pumps should make up at least 65 percent of residential heating, air conditioning, and water-heating shipments by 2030.

if you’re doing heat pumps in Europe, what’s your US GTM now? :D

💰 Meta will start charging a 30% fee on boosted posts for Facebook and Instagram iOS apps, passing along Apple’s fee from the App Store.

💡 Open AI launched Sora, an AI text-to-video model that can create realistic and imaginative scenes from text instructions.

it’s become a crowded space - a lot of VC-backed startup founders trying the same angles will all of a sudden have a very strong competitor - Irreverent Labs, Synthesia, Runway etc.

if you’re doing GenAI, you need to compete at the edge, at the top it’s insanely competitive.

also notable, OpenAI is reportedly developing a web search product that will compete with Google.

ARR hit $2 billion in December, and is estimated to double that figure by 2025. 80 billion valuation seems low.

🖖🏻 Many people are returning their Apple Vision Pros, saying the experience wasn’t worth the high price tag.

that’s because it’s $3500 a pop and basically just an entertainment device that can heavily impact your eyes and ultimately health

related: Zuck pissed on Apple Vision Pro’s parade, says Quest is better product, period.

Mo’ Sundaying

🇪🇺 The average age of Europeans is 44 years and 6 months old.

Italians have the oldest average - 48 years and 5 months - while Cyprus has the youngest one - 38 years and 5 months.

Between 2013 and 2023, Europeans, on average, aged by 2 years and 4 months - in 2023, the EU population was estimated at 448.8 million people and more than one-fifth (21.3 %) of it was aged 65 years and over.

The population is not growing due to a decline in births and the closure of borders to immigrants - which is what all politicians in Europe are selling in order to get votes, capitalising on peak nationalism and racism in Europe.

Slow and constant aging - older people with money are more resistant to change either. Europe is becoming an assisted living home, do you see the trend? Who’s going to work in Europe? Or fight against Putin, for that matter.

The Institut International d’Etudes Bancaires is the most exclusive and secretive networking club in European finance, where bank bosses rub shoulders with guests from presidents and prime ministers to royalty and central bankers.

For 73 years the IIEB has brought together the heads of Europe’s biggest banks twice a year at luxury hotels and royal palaces across the continent to discuss sensitive subjects such as M&A deals and global policymaking.

🤔 Politicians are puppets in the hands of rich people, the San Francisco edition.

🤭 New York City sued TikTok, Meta, Snap and YouTube for gross negligence, and public nuisance, saying the platforms fuelled the nationwide mental health crisis.

🤖 AI went crazy - Air Canada disabled its chatbot support system after one of its chatbots invented a refund policy, and a Canadian tribunal forced the airline to honor it.

Air Canada’s defense line in court: the chatbot is a separate legal entity that is responsible for its own actions.

Related: AI (Msft’s Copilot) is useful, but often doesn’t live up to its price.

🤘 Want to see something cool?

Flightradar but for satellites

West Coast startup tracking over 20,000 space objects.

just raised $29 million in a round led by GPBullhound

🦾 NASA is looking for volunteers to live in a simulated Mars habitat for a year.

✌️ Dawn is an avatar cafe in Tokyo where humans with disabilities control the robots from home.

Did you find this email useful?

Thanks for reading! Please send me feedback by hitting reply.

To support the project, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered use