Hello,

Welcome to Sunday CET - let’s get right at it.

Enjoy,

Dragos

Interesting startup deals

🇳🇱 Langwatch (API platform for LLM optimisation) - $1 million pre-seed

🇳🇱 Lemni (AI workers) - $3.5 million pre-seed

🇬🇧 Magdrive ((((plasma thruster for satellite propulsion) - $10.5 million seed

🇷🇴 Bible Chat (AI Christian counseling) - $14 million series A

🔒 More for Pros: signs of a stronger consumer app cycle in Europe, a Lovable-like Nordic startup crushing it, crazy valuations in volatile markets etc. Sign up.

Trends

Where we at: Markets are bad yet the Europe’s stock-market benchmark is having its best start to the year since 2019, outperforming the American ones - hedge funds in particular buying. Meanwhile, over the ocean the S&P 500 fell below its pre-inauguration levels and the US dollar has weakened.

Big boys moves: Rheinmetall is doing pretty well, considering. Prada wants to buy Versace. Unilever fired its CEO after less than two years. Wayve leaves IB analysts speechless and Bolt hired investment bankers for IPO - Klarna would very much like it so either as it keeps chasing trends for some mojo, while Revolut and Stripe are involved in giganormous secondaries these days.

Investor sentiment: how long VCs can keep pouring money into startups without getting much cash back from IPOs?

Startup signals: Lilium filed for insolvency - again. Bird is moving out of Europe. Hungry startups vs lazy startups in Euro defence tech. FOMO VC. SPVs are back with a vengeance.

Optimism but not really: the founders sentiment ain’t good.

- 45% of European founders say the business climate is getting worse- 66% say tech policy changes since 2020 have been unhelpful

- GDPR alone is estimated to have reduced small tech firm profits by 12%

The end of an era: Skype is being shut down in favour of Microsoft Teams - many of today’s high profile investors in Europe have made their first $ out of Skype fifteen years ago and still live off of that fame.

Macro positives: Italy bags $40 billion worth of Arab energy and data-center investments, following the same UAE’s $50 billion commitment to French AI.

+++ Estonia launched AI into schools - with the Americans rather than, say, Mistral? 😀 Pretty cool, nonetheless.Macro negatives: Finland's recession slipping towards depression. The price of coffee is surging to painful levels. Same with record highs cocoa ones, forcing heritage confectionary brands out of business. The Fear & Greed is at extreme fear. The Rolex index is down too.

Opinions

Paul Singer - markets as risky as I've ever seen

George Friedman - the new norm for a world without an anchor

Stripe’s annual letter - highly recommended.

Cheat sheets

Active angels and interesting deals from last year:

Also notable

🤔 An American investor recently told me: would you pay someone 100 bucks a month to keep you updated with what’s important in European VC? Filter out the media noise, break up the echo chamber and smartly connect the dots, a complement at par value to your professional job. A no brainer - he does and so can you.

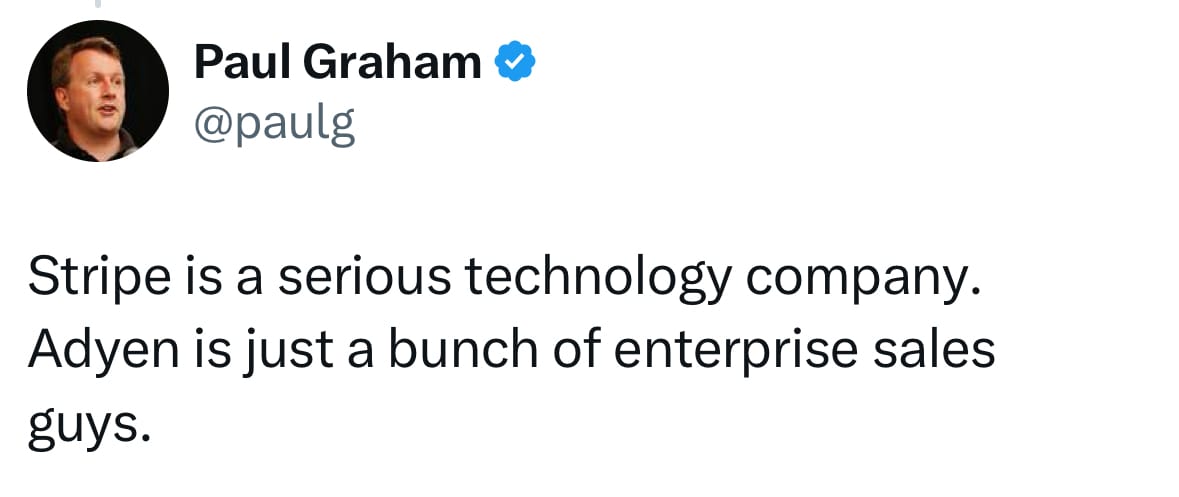

😱 Quote of the week - discuss.

🚘 European cars:

Volkswagen versus Ferrari:

- Ferrari sold 13,700 cars last year. Market cap $90 billion.

- Volkswagen sold 9 million cars last year. Market cap $40 billion.NB. Volkswagen also owns Lamborghini, Bentley, Porsche, Bugatti.

Europe’s new car registrations of Teslas fell 50% in Europe last month (including the UK, the decline was 45%) while Europe’s electric vehicle market overall rose 34% in the same period. Tesla stock is down 25% so far for the year - smaller offset compared to the 90% jump in about five weeks post Trump getting elected.

meanwhile, in London you see ads like this:

💲 The American economy depends more than ever on rich people - the highest-earning 10% of Americans are powering the economy at the highest levels since the 1990s.

🐻 Steve Cohen is bearish about DOGE and the American economy - Cohen’s Point72 did two startup deals in Europe this month btw, dully noted in our intel coverage.

🪺 The American prices for eggs went up to the roof - Make Eggs Great Cheap Again.

🇨🇳 China plans to inject at least $55 billion into its biggest banks in coming months as part of a broader stimulus package to revive growth in the economy.

🖖🏻 Attempts by central banks to use social media to reach young people range from cringy to laudable.

🦫 How long do we have to AEO - answer engine optimization?

🧑💻 The real reason behind the DeepSeek hype, according to AI experts.

🤳 Bluesky has launched an alternative to Instagram.

💃 McKinsey put out an AI template content package for the Linkedin thread bois. McK content is is free, Linkedin is free - that’s how the entertainment for business people circa 2025 gets done, ladies and gents! Linkedin for B2B, Tiktok for the masses, and Twitter for the American government ftw.

🇧🇪 The city of Ghent has seen the number of tourists double since 2010 - the Belgians are wary that there’s too many. Btw, quite a few Ghent-based startups have been raising early stage funding, per our tracking.

🤯 The largest crypto heist of all time happened a couple of weeks ago.

That’s all folks, have a wonderful week!

Did you find this email useful?

Thanks for reading! Please send me feedback by hitting reply.

To support my work, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.