Good morning and welcome to Sunday CET!

It’s mid August, everybody’s away and chilling, including myself - let’s get some brain cells working on this splendid weekend morning.

Every week we deliver manually curated intel from the European VC ecosystem. All you should know in a 5 minute comprehensive digest covering the long tail of the early stage activity from across the continent.

Don’t miss out - sign up here and get the next one on early Monday am.

Ecosystem pointers

Investors who slowed down this year This week I spent a half an hour looking into the data in order to figure who are the investors who really slowed down the investment pace in Europe compared to last year. So I crunched and compared the following data sets:

- the most active investors for the full 2022 based on the number of deals

- the most active investors for the first 6 months of 2023 based on the number of deals.

Who slowed at a minimum this year compared to last year’s frantic pace? Tiger Global, Index Ventures, GFC and Insight Venture Partners are among them.

Who kept a relatively good deployment pace this year compared to 2022? The likes of state-funded/operated vehicles, followed by private investors including Octopus, Eurazeo or Earlybird.

More names, data and comments in this cheat sheet available for our paying customers.

Other cheat sheets

- a review of the Euro fintech deals from this year - link

- European startups at Y Combinator this summer - link

- AI investors in Europe (dealers not talkers) - link

- notable American investments in Europe in H1 2023 - link

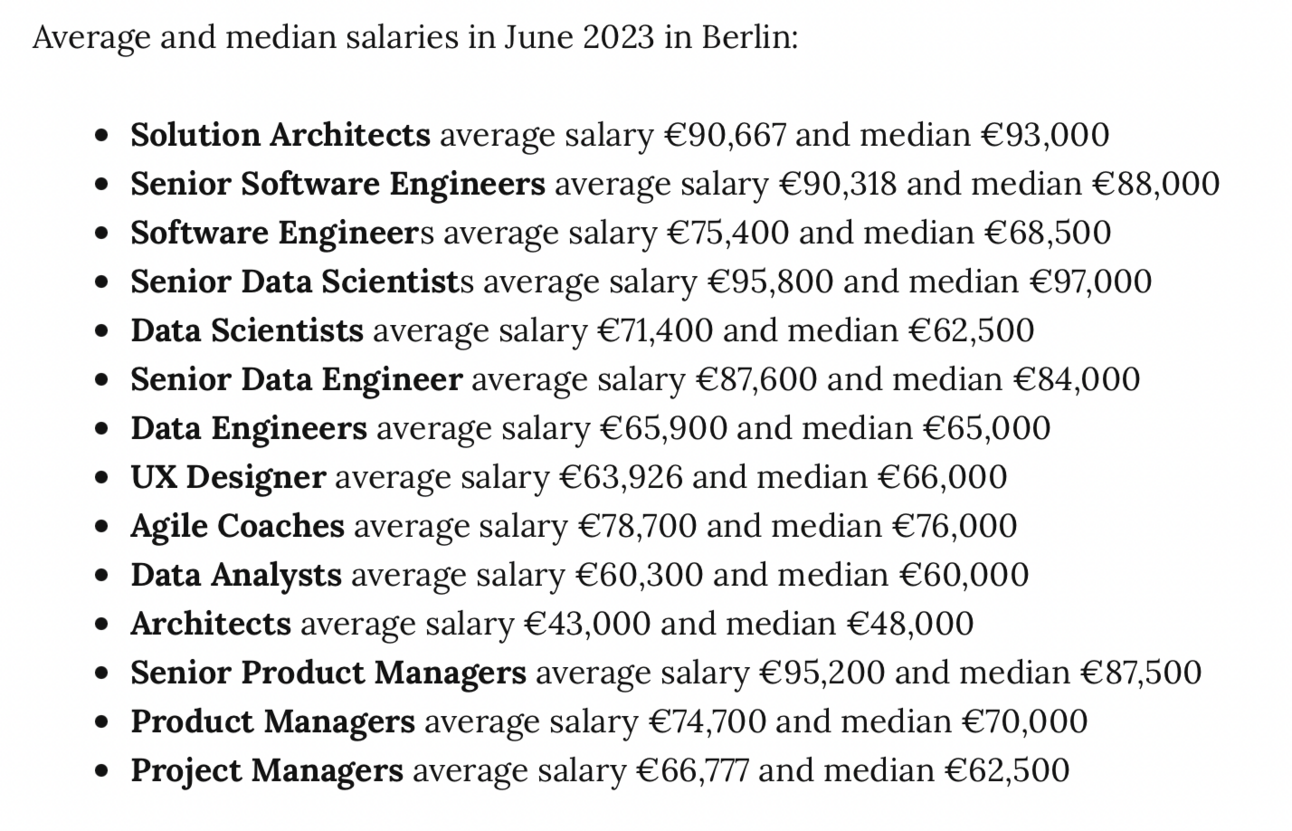

Berlin salary trends:

Building a startup is hard, the Stability AI edition:

Interviews with nearly two dozen current and former employees, investors, vendors and contractors describe a disorganized company helmed by an inexperienced CEO with a history of outlandish claims and lofty promises that don’t always come to fruition.

More here - fwiw, Stability raised $100M+ from Lightspeed and Coatue in 2021 and word on the street is that it failed to raise more this year at $4 bill valuation.

Omers Ventures, the venture capital arm of the Canadian pension plan, is pulling out of Europe.

Hopin’s assets were sold in a firesale for $15 million, a price that could get to $50 million subject to undisclosed targets.

Contextual add ons:

Entry to Y Combinator has become the most competitive it’s ever been.

The factory model system of seed investing is dead (is it? :P).

Your startup needs to have an exit potential of 10-20x the size of the VC fund to have a match.

In 2020-2021 we invested in 24 startups based in Emerging Europe out of our first fund - how are the startups doing mid 2023?

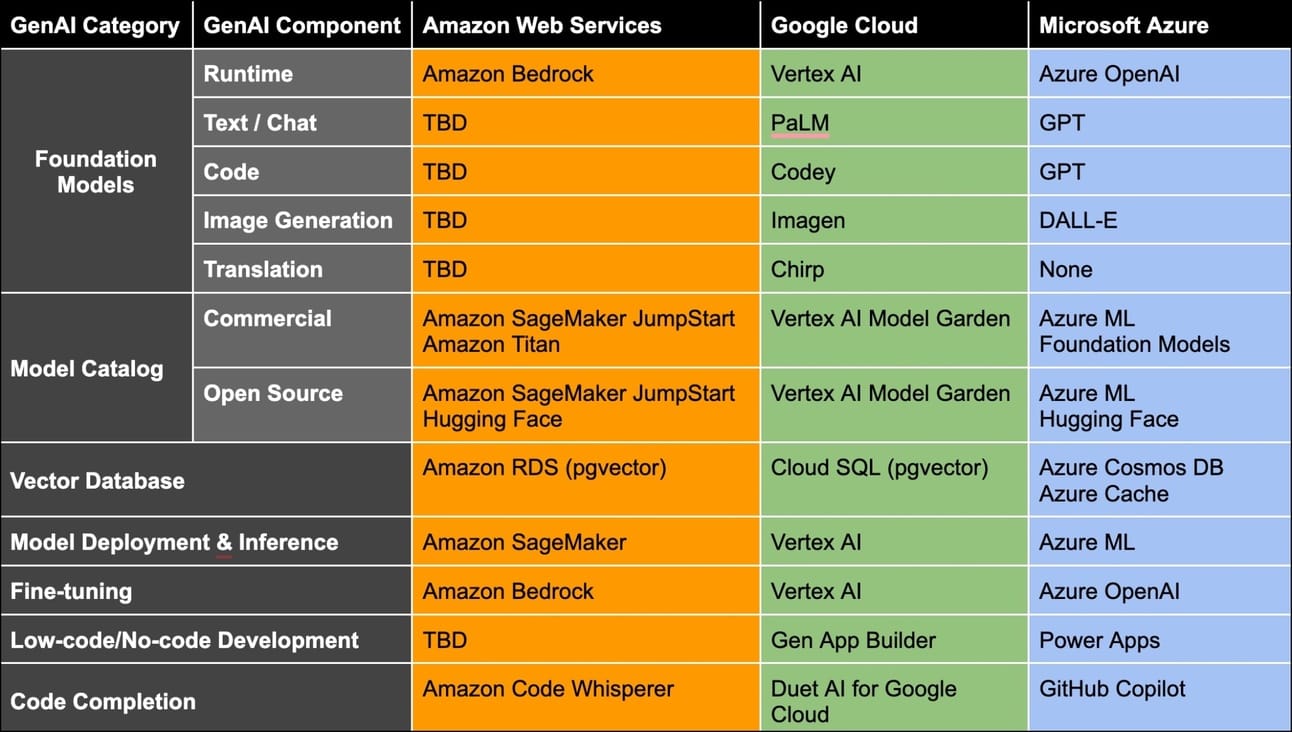

Another day, another VC with an investing framework into Generative AI applications.

You can frequently read articles referencing VC "dry powder" and inferring that these large dollar amounts are "burning a hole" in someone's pocket & will imminently find their way to the market. But things don't really work this way.

Sometimes a winner take none market can emerge when a technology breakthrough just didn’t pan out, or there’s a dramatic change in customer needs/expectations.

A conversation with Paul Graham, and another with Marc Cuban.

Startup radar We have started sending a new weekly email to our Monday CET subscribers with a curation of interesting early stage startups from Europe (we come across TONS of industry intel every week) based on signals such as product, business model, growth, key investors, or team.

Think of it as a personalised startup sourcing concierge - if you want to get an idea, you can sift through a list of 30+ startups from this cheat sheet (available for free for the next 24 hours) and can subscribe from here for getting such a list every week, alongside cheat sheets focused on European VC and startups intel. High signal, zero noise - we send our next intel digest tomorrow in the AM, get it too.

Don’t miss out!

Do you like Sunday CET? You will love Monday CET!

Get in your inbox Europe-focused intel with VC moves and early stage startups usually not covered by MSM.

👇 Start with a free trial, cancel anytime | Read a previous issue

Other notes

🇳🇱 Booking hasn’t been able to pay their accommodations partners for more than a month because of their ongoing SAP migration. SAP is the most valuable European software company.

🇪🇸 Barca Media, the media unit of Spanish soccer club FC Barcelona, will go public at a $1 billion valuation.

🇪🇺 As Fiona Scott Morton was bullied out of the EU's chief competition economist nomination for being American - the new favorite for EU competition economist is Florian Ederer, a newly minted US citizen but also an Austrian - with no history of consulting for Big Tech companies.

🥕 A hot Israeli startup promised to use artificial intelligence to spread the risk of insurance policies. Now, Vesttoo is embroiled in scandal thanks to an old-fashioned problem: an alleged multibillion-dollar fraud involving faked letters of credit.

💲 Wealth positioning

📺 Pricing positioning

👁️🗨️ WeWork replaced directors who resigned with experts in large financial restructurings as it raised doubt that it can stay in business. This was once one the most valuable startup ever known for its founder Adam Neumann’s ability to extract money from SoftBank, collecting hundreds of millions of dollars for himself at the peak and then walking away (for more money!) as WeWork crashed.

Speaking of SoftBank - this week it shocked markets with a surprise loss in the first quarter covering April-June, even as Vision Fund back in black after five quarters.

💔 What Apple did to Nokia, Tesla is now doing to the motor industry.

🔢 Doximity’s financials breakdown (LinkedIn for doctors, popular in US)

🗳️ Amazon is considering a new way to deliver your packages, without a box - a Frustration-Free Packaging policy that reduces the amount of packaging material.

🎵 Google is in talks with major music labels to license artists' voices and tunes for AI-generated songs.

🚗 Waymo and Cruise have gotten permission from California regulators to run robotaxis 24/7 in San Francisco.

Bonus link: San Franciscans are having sex in robotaxis, and nobody is talking about it.

Otoh - amid a surge in crime in Oakland, police have advised residents to use air horns to alert neighbors to intruders and add security bars to their doors and windows. It’s really bad.

📉 Average rents in Manhattan are now up 30% compared to 2019. The average monthly rent in July was $5,588, up 9% over last year - insane.

💲 What doctors make on average by specialty in USA - top 3:

- neurosurgery $920k

- orthopedic surgery $788k

- radiation oncology $709k

👀 What an arm race looks like

🏠 This report takes a deep dive into why homeowners complete outdoor remodeling projects, the value of taking on lawn and landscape upgrades and enhancements, and the increased happiness experienced by homeowners once an upgrade is completed.

🇺🇸 Americans are drowning in a staggering $1 trillion credit card debt. As interest rates rise, more and more people find themselves trapped in an endless cycle of debt.

🇨🇳 US President Joe Biden signed an executive order banning American investments in key technology industries that could be used to enhance Beijing’s military capabilities. The order will prohibit venture capital and private equity firms from investing in Chinese efforts to develop semiconductors and other microelectronics, quantum computers and certain AI applications.

"The thing we're trying to prevent is not money going into China overall, because they have plenty of money," says a senior administration official. "The thing they don't have is the know-how."

The EU, on the other hand, is unwilling to follow suit straight away and says it will issue its own proposals by year-end.

🇬🇧 Is Britain really as poor as Mississippi?

Removing London’s output and headcount would shave 14% off British living standards, precisely enough to slip behind the last of the US states. […]

By comparison, amputating Amsterdam from the Netherlands would shave off 5%, and removing Germany’s most productive city (Munich) would only shave off 1%. Most strikingly, for all of San Francisco’s opulent output, if the whole of the bay area from the Golden Gate to Cupertino seceded tomorrow, US GDP per capita would only dip by 4%.

#️ Students are “magnetic targets” for spies, the head of MI5 has warned.

🇯🇵 Square watermelons in Japan.

Upgrade!

Do you like Sunday CET? You will love Monday CET!

Get in your inbox Europe-focused intel with VC moves and early stage startups usually not covered by MSM.

👇 Start with a free trial, cancel anytime | Read a previous issue

Did you find this email useful?

Thanks for reading! Please send me your thoughts or comments by hitting reply. To support the project, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.#157