Hello - welcome to Sunday CET!

This week:

Are early stage VCs and YC substitute products?

what a good startup trajectory looks like in Europe

yungblud VCs

Enjoy,

Dragos

Have you tried Nordic 9 yet?

Nordic 9 sits on a comprehensive startup deals and investors database - dead simple UX, no frills and well-structured with proprietary data covering all the 30 European countries.

Nordic 9 is the best way to get familiar fast and stay updated with who’s who in the Euro VC land. Data is assorted with a 200 cheat sheets library + weekly intel covering verticals, geographies and whatnot from the European startup world.

👇 Try it now. 👇

Deals highlights this week

🇮🇸 Rocky Road, gaming studio developing a casual open world mobile game built on real map data, raised $3 million in a seed round led by Luminar Ventures, joined by Crowberry Capital, Sisu Ventures, and angel investors David Helgason and Matthew Wilson. (TechEU)

🇸🇪 Ekolution, producing carbon-negative building materials, raised $5.1 million series A from local private investors, on top of a $8.5 million grant raised from EU funds. (press release)

🇫🇷 Stoïk, insurance startup helping SMEs being covered in the event of a cyber-attack, raised a $10.7 million series A extension round led by Munich Re Ventures, joined by Opera Tech Ventures, Andreessen Horowitz and Alven Capital. (press release)

🇦🇹 Metaloop, operators of a scrap trading marketplace that connects metal sellers with buyers, raised $17.5 million series A led by FirstMark Capital, joined by FJ Labs, Statkraft Ventures and Silence VC. (Techcrunch)

🇩🇪 Plan A, B2B automated SAAS that lets companies measure, monitor, reduce and report their ESG ratings, raised $27 million in a Series A extension round of funding led by Lightspeed Venture Partners, joined by Visa, Deutsche Bank, and Opera Tech Ventures. (press release)

-

We cover (much) more early stage intel from the European long tail every week over at Monday CET.

Tomorrow’s update will be a monster piece packed with one of the more interesting Nordic plots in some time, many early stage deals (and extensions!), quite a few people jumping on new jobs etc. Sign up to get it too, it comes with a free trial and it’s free if you’re a Nordic9 customer.

Cheat sheets

Startups

Fintech deals 2023 - who and what

Who invested in AI in H1 2023? link

Overpriced Euro seed deals H1 2023 - link

Q2 series A deals in Europe - link

Investors

Investors who slowed down Europe funding in 2023 - link

Most active investors in Europe 2023 - link

Notable American investments in Europe in H1 2023 - link

American investors in Europe - who are they

What non-locals invested in in Europe in 2023 - link

Think it’s going to get better?

Stories

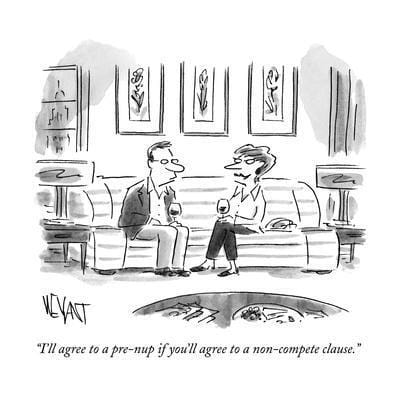

😇 Here’s a Techcrunch piece reporting the dirt of an unexpected public spat between YC leaders and a competing startup accelerator. YC has been in the spotlight for a long time now, that’s a sign of success, with many early stage investors complaining that YC startups are more expensive to what they can buy from market.

What folks don’t actually say but it’s implied is that VCs see YC as their direct competition - YC doesn’t really compete with other accelerators but rather with top early stage, first check VCs, as they provide similar value add, differently priced - the same bundle of services, often with less dilution. Mentoring? Check. Network access? Check. De-risk help and intros for the next round? Check. They’re substitute goods at the high end of the market - and yet everybody’s gotta make their own models work in the back end, because they are different at fundamental levels.

So that’s the key you need to use whenever you see an early stage VC complaining about YC not being worth it for startups. Competition sucks. Founders will always align their decisions to their startup’s best interest, which more often than not is not exactly the same to investors best interest. Those interests are usually aligned only if the startup gets to billion dollar valuations rather fast - that’s rare, the trajectory is never straightforward, and more often than not high early stage valuations, which YC’s work leads to, do not compensate investors properly for taking the early risks with them because of the bumpy roads.

YMMV, but here’s a simple example: pre-revenue startup that raised at a hefty $10M post which needs a bridge because of stalled growth 12-18 months later - that means raising at the same valuation, or even lower, which means more dilution for the early investors, not a mark up. And it can go on if the PMF takes even longer than the 12-36 months growth cycle mode modelled by investors. Startup work is hard and requires time to figure out, so unless the growth has a rocket trajectory, a first check investor can be a risky position.

If investors perceive you as a top startup, you definitely have the optionality of choosing between YC vs smart VC money. It’s a nice to have problem though - for the rest mere mortals getting into YC has more meritocratic basis, but the odds of it are lower than successfully selling equity to a VC. No smart founder will join any to get an education - they’re after access, namely tapping into a network that would make it easier to raise next rounds and/or to find customers. Yes, they might expect working with Mr Wolf sometimes but any kind of deal a startup takes, getting access to networks and relationships otherwise un-available or super expensive to create will prevail. Money is just a mean to an end, relationships make the world go round.

🔢 Here’s an example of a good trajectory and what a successful European growth story looks like, which should make for happy investors.

That’s from Cleo’s August trading update, btw.

Note the Jan 18-Jun 19 (pre-monetisation) and then even further until the second part of 2020 (early payers) - 24-36 months of the curve that’s the crossing the chasm period and after which the real PMF starts to kick in. It’s even longer if we’re to be honest, as the company was founded in 2016.

That’s time to figure things out. Do you know how much money Cleo raised in that period?

Jan 2017 - 700k

Jul 2017 - 2.6M

Sep 2018 - 10M

Dec 2020 - 44M

That’s almost 15 million pre-ZIRP, still teen VC era in Europe for getting at PMF - fwiw, Cleo has raised about 150 million from professional investors in total as of now. Alas, not diminishing in any way the team’s merits, but also they raised from tier 1 European investors right from the angel round. Or, as mentioned above, the smart money competing with the likes of YC.

One last thing. For noobs, what does Cleo sell?

AIConsumer financial products for people in their 20s, via a nice yet complex software app that also uses a bit of machine learning, as it should in the 21st century. Saying that Cleo is an AI startup is like saying about computers they’re electric just because they use electricity for charging their batteries. It’s just silly.

🎙️ Finn Murphy is always a good dude to listen to and learn from, one of the up and coming early stage investors in Europe. For those who don’t know already, he’s an Irish who’s learnt the ropes at Frontline for 5 years and now he took the crazy path of being a founder of his own VC fund. He has that humble innocence that creates trusts, which everybody seemingly has at the beginning of the journey and which usually fades away as business scales out. Btw, love that he took the unusual way of also competing in the States where it’s 10x harder than in the Euro space, where he already has the network and also where, to quote an investor friend, “it’s full of bozos”. That shows he’s competitive and hungry - yes, it is harder to win deals in the States, but why limit your scope by design when opportunity is everywhere, and sometimes bridging markets can have more benefits than having to juggle them at the same time. It’s also true that this works better on a lean op, and he’s a solo GP.

Speaking of good investors, and if you’re curious to take the pulse of the American venture market you have to listen to this - how top dealers look at the AI market, and in general how they understand to do their job in a professional way. TLDR: AI is just a bubble, ‘patient arbitrage’ is a concept, reality is not what you read in the media about the venture business and American dudes are far from how European investors do business around here.

💰 More on the VC business:

Specialist funds are the clear winners when it comes to vehicles under $250 million both in terms of IRR and TVPI.

For vehicles over $250 million, the generalist funds have a slight edge.

🛴 Tier exited the American market by selling at big loss and it is still looking for a white knight to relieve them of the duty of having to deal on their own and give their investors some minimum liquidity. Because business wise there’s so much a scooter startup can grow.

Bonus link: scooter company Bird delisted from NYSE after stock collapse, and will trade over the counter.

🇫🇷 Good profile of Beyond Aero, the French building aircrafts using hydrogen propulsion.

🇫🇷 En passant food for thought visavis the French startup bubble deflating - is Xavier Niel the creator of the French ecosystem? I know some French who’d think otherwise, but does it really matter?

😕 Was Bob van Dijk of Naspers/Prosus fired? He’s been a CEO for 10 years and was the highest-paid CEO in the Netherlands last year, with a total compensation of 57.5 million euros.

🇪🇺 The EU is going after greenwashing, the practice of making misleading claims as to a product’s climate friendliness - and will ban sweeping environmental claims such as ‘climate neutral’ or ‘eco’ by 2026 unless companies can prove the claim is accurate.

🇪🇺 Somebody actually spent time to write about the obvious - applying for the EU grants is a horrible experience - I am guessing just to be able to produce this masterpiece sentence exclusively for Sifted:

[…] the EU's definition of 'great' is more like marrying safety with a flirtatious wink at innovation, all wrapped up in a nice thick blanket of bureaucracy.

The underlying idea is, of course - how can you trust the EU guys and take them seriously with anything they do or say about startups and uhm, innovation, if dealing with them screams utter incompetence? And btw, the least resistant path for getting EU grants is paying a professional third party to deal with most of the process - call it the ‘EU innovation market’ economy.

Mo’ Sundaying

👆 We’re looking to grow Sunday CET’s reach on Linkedin (I know), updated daily with deals and intel we’re coming across by managing Nordic 9. No-clickbait, utility-driven stuff, please follow and help us spread the word - thanks.

🇺🇸 The Americans are working on legislation aiming to inject more competition into the credit card industry to lower the fees merchants pay whenever shoppers swipe their credit cards - those are the primary revenue driver among credit card companies.

If it goes through, the law has the potential to significantly negatively alter, if not completely eliminate, the huge business of credit card rewards. link

👁️🗨️ Tinder has unveiled a $500-per-month exclusive subscription service to the dating app’s most active users who will have access to features including VIP search, matching, and conversation.

It is basically a premium charge for the core of the product Tinder started with back in 2007. As the product scales, you over-complicate it with tons of useless features for attracting mainstream users and then charge a premium for the initial utility that drew your early adopters. That’s the cycle of software products.

🥕 Amazon will only allow authors to self-publish 3 boks per day - in a move to combat a glut of AI-generated books.

💪 The Internet is really owned by just four companies: Alphabet, Apple, Meta and Microsoft.

💡 Sometimes old school business is working just fine - Cargill’s business model has worked for 158 years.

💲 If you have an extra $1 billion in your hands, you can buy the naming rights for Harvard Medical School. Just saying.

Or you you can buy a stake in the NBA team GSW at a $7 billion valuation. Existing investors group purchased team in 2010 for about $450 million, but being jealous on other people’s wins shouldn’t stay in the way of a good deal.

🇮🇪 The Irish are on it - fewer essays, more oral exams, no online tests: shake-up to prevent students using AI to cheat.

🇬🇧 If you believed the paperwork, Henry Drive in Leigh-on-Sea, Essex, would be a thriving business metropolis specialising in the wholesale clothing market with entrepreneurs from across Europe choosing the Essex street as their operations base.

The mass registering of these firms is probably the work of criminal gangs using sham companies for money laundering or to obtain bank loans before shutting them down.

🇸🇪 A peculiar Swedish thing: the Raggare culture.

🇮🇸 Check this out, next time you’re in Iceland.

🇺🇸 More Americans than ever are dying from fentanyl overdoses as the fourth wave of the opioid epidemic crashes through every community, in every corner of the country.

💔 The more expensive a wedding is the more likely you are to get divorced. Really.

📱 Do not buy an iPhone 15.

🤯 Much of the developed world doesn’t understand how major transitions work, especially in midlife.

🛰️ Google was sued by the widow of a man who died after driving off a collapsed bridge while following the company’s GPS directions, which had not been updated.

Upgrade!

Do you like Sunday CET? You will love Monday CET!

Get in your inbox Europe-focused intel with VC moves and early stage startups usually not covered by MSM.

👇 Start with a free trial, cancel anytime | Read a previous issue

Did you find this email useful?

Thanks for reading! Please send me your thoughts or comments by hitting reply. To support the project, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.