Good morning and HNY everybody!

We’re ten days in and feels like the year has started ages ago. So many events happening so quickly, which in normal times would have taken months or even years cycles - and now crammed in a 1-3 days. Every day feels like watching history being written in real time - it’s a crazy world.

Today, we’ve got an awesome interview with Rainer, one the five GPs of Germany’s largest VC fund, HV Capital. Some quote bangers:

Munich is the best place in Europe to build a generational startup today

current environment is defined by very short cycles, incredibly high momentum

European tech and funding is entering a decade of disruptive transformation and unprecedented opportunities

we’re not in an AI bubble

The whole piece is absolutely worth it, scroll down for it.

Also today - how many IPOs were in Europe in 2025 and how a16z’s 15B compare to European peers. And many other stories - as always, hit reply with thoughts and comments

Enjoy,

Dragos

Have you tried Nordic 9 yet?

Nordic 9 sits on a comprehensive startup deals and investors database - dead simple UX, no frills and well-structured with proprietary data covering all the 30 European countries.

Nordic 9 is the best way to get familiar fast and stay updated with who’s who in the Euro VC land. Data is assorted with a comprehensive cheat sheets library + weekly intel covering verticals, geographies and whatnot from the European startup world.

👇 Try it now. 👇

Market talk

We are doing an interview series for taking the pulse of the startup market through the eyes of the investors. This week - Rainer Märkle - GP at HV Capital, the largest venture capital firm in Germany. For those who don’t know already, HV was founded in 2000 as a corporate venture arm of the Holtzbrinck Publishing Group, became an independent firm in 2010 and rebranded to HV Capital in 2020.

What's new with HV Capital, and what are the highlights of 2025?

2025 was such a busy year: 20 new investments with more than €200m deployed only in 2025, our portfolio in on track to raise more than €2bn this year alone.

Highlights are some technology breakthroughs, unprecedented operational growth and financing rounds such as n8n and Quantum Systems.

How would you describe the European tech and funding environment right now in one sentence? Do you expect major corrections to come or are we in a normalisation period - and what does 'winning' in European venture looks like in the 2030 timeframe?

European tech and funding is entering a decade of disruptive transformation and unprecedented opportunities.

I do not expect major corrections (other than in late-stage AI) but rather more tailwind for more opportunities - and capital to follow those.

HV Capital is competing against massive American multi-stage platforms and specialized seed funds - where does HV sit in that squeeze?

HV Capital comes in strictly before the American multi-stage platforms who come on board in follow-on rounds after us.

And we are the strong first generalist investor after specialized seed funds, helping companies to really scale.

A clear and strong position to be in, only possible with our 25 year / 280 investments done network.

Are bets like defence and tech defining the 'European Sovereignty' thesis actually driving returns for Euro VCs, or is it just a nice narrative to justify why we aren't competing with the US on pure software margins?

Definitely driving returns for us, just look at portfolio companies such as Quantum Systems

Which sectors will produce the next German unicorns - and which sectors are structurally incapable of producing them now? And is Germany prepared for a world where technology is increasingly militarized?

How could I not say AI and deep tech?

But we see Unicorns growing up in our portfolio in Consumer, Fintech and other sectors as well.

We do not see any structural disadvantages for most sectors.

Germany is not quite there yet, but some strong initiatives are started.

What do you think is the best place in Europe to build a generational startup today? Why?

Munich.

Unparalleled combination of universities, talent pool, industry, ecosystem and capital.

Are we in an AI bubble, or just witnessing the early phase of a multi-decade platform transition? What is a major shift in the next three years that almost no one in the startup world is talking about yet?

I would not say we are in an AI bubble, but I assume I sleep better as an early/growth investor in AI than the very late-stage guys.

And please let me know once you hear about that major shift over the next three years, we will definitely invest.

What are some interesting startups you came across lately?

It would be unfair to mention specific names here, but definitely in the areas of deep tech and AI.

Now, that is already mainstream again, so very curious what will come out in 2026.

What’s the most promising AI investment you passed on and what did you learn from the decision? And conversely, which company in your current portfolio best reflects where the world is heading?

We are fast learners, so after passing on n8n in the early stages we invested in the early growth stage.

I guess it is also a clear example of where the world is heading: very short cycles, incredibly high momentum, the world changes so fast.

Everybody in our industry will remember that day when chatGPT launched and how it changed everything upside down.

What’s one piece of advice you find yourself giving repeatedly to startups in today’s environment?

Always be very careful of not resting on merits and just staying on your path, but rather be closely tracking and responding to where new topics are moving.

You can read all the interviews here. Who else would you like us to do next? Hit reply with your favorits!

What clicked in 2025

Looking back at what Sunday CET readers clicked on last year, I thought it’d be interesting to put out the list with what you engaged the most:

15 unpredictable scenarios for 2025

Patrick Collison’s pros and cons for Europe and US

how Chinese corrupted EU officials

why best VCs are magnets for exceptional startups

Stripe’s 2025 annual report

which countries people leave UK for

how to make friends past age 30

an intellectual’s travel guide to Madrid

Peter Thiel’s podcast with Joe Lonsdale.

What do I want to do this year?

The silver line is cutting through noise, and provide clarity about what matters - what’s actually happening, changing and what to do next.

I would like to write more. Last year I did a record number of cheat sheets - I have so many ideas I want to delve more on, need to find the right rhythm and proper motivation for it.

Interviews were a good add-on, which you seemed to click with. Will double down on them.

The objective is to be useful - the war for attention is high these days, and truly appreciate the time every single one of you takes to open, share or comment.

I like that my work is inspirational for people making media for a living - those guys make for a constant loyal audience. 😀

More signal. Less noise. Clarity. Opinion.

Not least, enjoy it. Doing Sunday CET every weekend is part of my routine and of who I am and I truly love putting it together.

Looking over the numbers, the engagement is consistent - and I would like to thank you all for that.

What do you want to see more out of Sunday CET?

Signals

Interesting early stage deals

🇬🇧 Biographica (AI for developing new agri crop traits ) - seed

🇮🇹 Principled Intelligence (AI for safety and compliance) - pre-seed

🇪🇪 Rollo Robotics (autonomous monowheel security robot) - seed

🇩🇰 Sparrow Quantum (photonic quantum tech components) - series A

🇩🇪 UMH (real-time industrial data hub) - seed

More

investors on the move

the most interesting 500 Euro early stage/stealth startups in 2025, by country

AI for prediction markets

We add more signals on Linkedin and keep a religious track of what’s interesting in Europe on Nordic9.

We produce intel notes for the best investors in Europe every week - join them!

Also notable

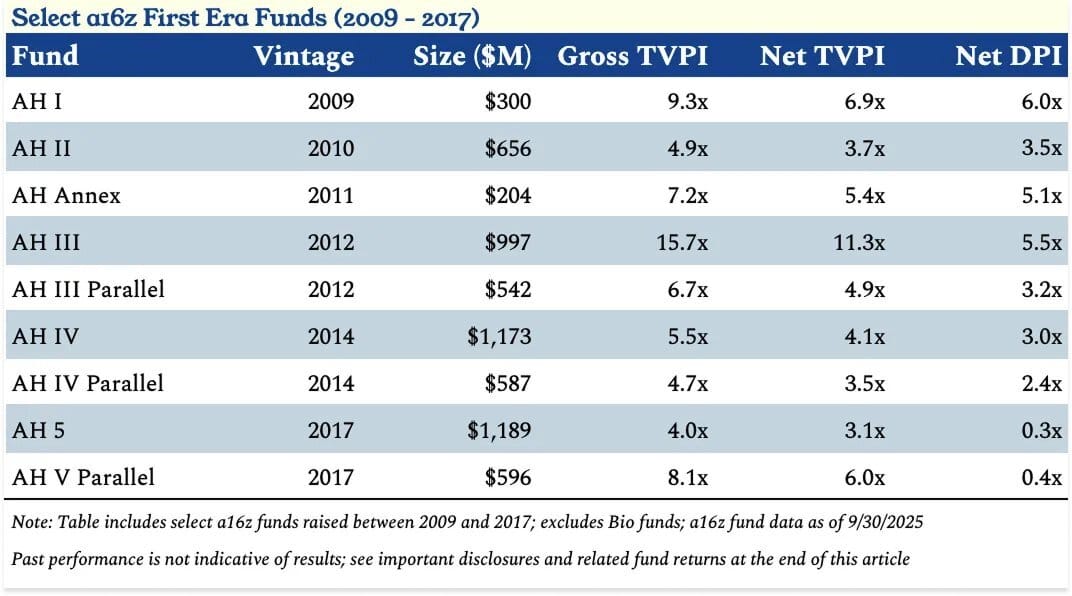

💲 Mega funds are back! a16z just raised a new family of funds totalling $15 billion:

Growth Fund ($6.75 billion) - focused on scaling late‑stage startups.

Apps Fund ($1.7 billion) - targeting consumer and enterprise applications.

Infrastructure Fund ($1.7 billion) - backing core tech infrastructure companies.

American Dynamism ($1.176 billion) - investments tied to defense, aerospace, and strategic U.S. sectors.

Bio & Health ($700 million) - focused on biotech and healthcare innovation.

Other venture strategies ($3 billion) - a mix of new or yet‑to‑launch vehicles

An updated primer on a16z here, from where I got the below:

Worth noting that $15B is 6-7X the next biggest single European fundraising - Index Ventures that is. Below a list with the larger ones in Europe:

Index Ventures $2.3 billion (2024) - multistage

Forbion $2.3 billion (2025) - multistage life science

Monterro $2 billion (2025 - not a pure VC in the classic early‑stage sense, but one of the largest raised in Europe recently

Balderton $1.3 billion (2024) - multistage

Atomico $1.2 billion (2024) - growth

Cathay $1 billion (2025) - multistage

Eurazeo $770 million (2025) - growth

For the market, this widens the gap between mega funds and everyone else, as well as reinforcing Europe’s capital gap with the US. It’s power-law concentration - a small number of mega-funds now control a disproportionate share of deployable venture capital.

That means that what’s good is going to cost more, while in Europe the local LPs may gather more confidence and help local funds raise larger vehicles. Specialization and building specific edges will become more important than ever, as the local VC ecosystem will likely consolidate, with fewer but larger players dominating Series B/C funding, while early-stage seed rounds remain fragmented.

All in all, in Europe the barrier isn't the money anymore. It's the ambition to ask for it - capital is available for the best companies, in the favoured sectors, led by a small number of dominant firms. Everyone else competes around that gravity well.

📉 IPOs in Europe - do you know how many IPOs were in the main European hubs last year? I was working on some research materials this week and got curious about it. Here’s what I found:

Deutsche Börse / Frankfurt Stock Exchange - 3 IPOs and €1.186 billion, €808 million of which out of Ottobock’s IPO.

LSE - 11 new listings where companies raised at least $5 million, totalling $2.55B (£1.9B)

Nasdaq Europe (Nordic & Baltic markets) - 19 IPOs totalling about €6.1 billion

The Verisure IPO on Nasdaq Stockholm raised €3.1‑€3.6 billion, making it the largest European IPO of 2025 (and the biggest in Sweden in over two decades).Euronext - 50 new companies representing an aggregated market capitalisation of €17 billion.

Also looked up the US for a proper benchmark - 202 companies completed IPOs in 2025 on US public markets, with approximately $44 billion in gross proceeds.

😭 German investors are great - they have lost €1.1 billion of their money and are blaming everybody but themselves:

“A German pension fund whose foray into private markets led to losses that totalled half of the fund’s assets has begun legal proceedings against its former auditor, an adviser and its own managers to recover the damages.

The fund known by its German acronym VZB is suing Dusseldorf-based Apobank, the German unit of Forvis Mazars in Hamburg, the Berlin city government as well as nine former managers, according to a court filing seen by Bloomberg News.

VZB, which caters to more than 10,000 dentists in and around Berlin, has said it’s facing losses of about €1.1 billion ($1.3 billion) after many of its investments — including backing a shrimp farm — went bad. It had about €2.2 billion in assets under management at the end of 2024.”

🦾 Europe is quietly building a geopolitical AI hedge. It’s infrastructure that matters - more people should talk about this.

💲 Top hedge funds of 2025 and their returns:

Bridgewater Associates – Pure Alpha fund: ~34% (highest)

D.E. Shaw – Oculus fund: ~28.2%

D.E. Shaw – Composite fund: ~18.5%

Balyasny Asset Management: ~16.7%

Point72: ~17.5%

🇪🇺 Inflation numbers in December:

Germany - 2.0%, down from 2.6% in November and below forecasts of 2.2%.

France - 0.7%, slightly below the prior month and expectations.

Spain - 3.0%, easing from about 3.2% in November.

Italy - 1.2%, up slightly from 1.1% in November.

Netherlands - 2.5% in December, down from about 2.6% in November.

The EU-harmonized rate also fell to 2.0%.

ECB’s primary mandate is to keep it “close to, but below 2%” over the medium term. If inflation goes below 2% → ECB may consider holding or easing rates, unless other conditions (growth, wages, energy) push otherwise.

🚘 BYD outsold Tesla last year in Europe’s two largest electric-vehicle markets - Germany and the UK - as the Chinese automaker continues its rapid global expansion.

meanwhile in Germany, pure battery-electric vehicle registrations from the Volkswagen Group exploded in 2025 → +75% yoy.

𖥂 AI-powered drones are at the center of a new arms race - Ukraine is ‘the place’.

📺 Lidl to drop broadcast TV ads in France complaining that the local regulatory risks are too high - they were sued by the government for deceptive advertising and lost. The Germans are France’s second-biggest advertiser, across all sectors and media

🏦 JPMorgan will take over Apple’s credit card program, ending Goldman Sachs’ disastrous push into consumer lending - JPM expects over $20B in card balances.

📊 OpenAI has launched a new ChatGPT feature in the US which can analyse people's medical records to give them better answers - not available in Europe or UK yet. As mainstream tools are moving toward personalized health guidance, this will expand the whole preventative health category, interesting to follow how the dedicated startups will go deeper to differentiate - my guess is that they’ll emphasize custom coaching with real-world feedback loops as well as do a more direct integration with clinical services.

👀 Reddit overtook TikTok as the fourth-most visited site in the UK - YT, FB and Instagram are the top three (the whole report is worth a look). Meanwhile, the EU intends to intensify its big tech focus in 2026, in regulatory moves that are expected to lead to renewed clashes with US big tech groups and President Donald Trump.

🤖 Traditional offshoring - moving human work to lower-cost regions - is being replaced by robotic offshoring, where machines increasingly perform both physical and cognitive tasks. Robotics adoption is accelerated by falling costs, AI-driven world models, and scalable infrastructure, enabling companies to deploy automated labor anywhere at lower long-term costs than human employees. link

🎙️ Good interview with Matt of Elevenlabs.

That’s all folks, have a wonderful week!

Did you find this email useful?

Thanks for reading! Please send me feedback by hitting reply.

To support my work, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.