Hey there,

Welcome to Sunday CET - quick reminder for new people on the list, name is Dragos and this is a weekly digest I send every Sunday with what I find interesting in the VC land from Europe.

Thanks for reading - don’t be shy and hit me up with comments and feedback, I try to respond to every each of you!

Dragos

In-depth intel you won’t find elsewhere

Nordic 9 is the best way to get familiar fast and stay updated with who’s who in the Euro VC land.

The startup deals and investors database are assorted with a library of hundreds of cheat sheets + weekly intel covering verticals, geographies and whatnot from the European startup world.

👇 Subscribe now 👇

Use code SPORTLOV at checkout and get €100 off for purchasing a one year plan.

Market talk

Expensive seeds from last year

This week I had a look at what VCs dealt at seed levels in Europe - I was interested to take the pulse of what investors valued the most at very early stages.

methodology first:

I looked at seed deals with a minimum $5 million in capital raised and I did not include seed extensions and certainly missed a bunch of interesting transactions that were still not made public (I know quite a few but at N9 we record only public data).

I considered that over-priced seed deals were closed at more than 10 million, followed by a 'tad expensive' category of those closed in the 5-10 million range.

the creme a la creme of the first part of 2023 is in this cheat sheet.

compared to the first part of the year, they’re smaller though - putting Mistral’s 114 million seed aside, we had another carbon removal bet, twice as expensive as Isometric ($45 million) and two football games - one from Sweden that’s yet to be launched ($20 million) and a Spanish one that moved to USA (21 million)

other interesting albeit expensive bets from the second part include:

I also liked:

🇬🇧 Sunsave (sub for consumers to switch to solar power energy),

🇩🇰 spektr (automated customer compliance),

🇬🇷 Lambda Automata (autonomous systems for national security) and

🇵🇹 Scoreplay

reminder for noobs - the UK, France and Germany are Europe’s top markets in terms of VC-backed startups.

in general, the second part of the year seemed to have a slower deployment pace at early stages throughout the continent, compared to the first part. Might be also a bit of reporting lag.

all in all, we ended up with a list of about 80 interesting early stage startups to dig through a cheat sheet, alongside with another hundred expensive early stage ones from the first part of the year available here - that should give you a good picture of what investors value the most in Europe at early stage.

More cheat sheets

Intel highlights from this week

get them on the email alongside access to comprehensive proprietary data, long tail moves and strategic intel → subscribe.

use code SPORTLOV at checkout and get €100 off for purchasing a one year plan.

You will get the best early stage intel in Europe money can buy.

Also notable

🇸🇪 This week the conflict at Klarna went on and it is likely put to bed now. It took about two weeks of uncomfortable PR for both the Swedes and the Americans.

Victor controls 6%, Sebastian 5% and Sequoia 22%.

it all started with Mike Moritz stepping down from Sequoia last summer which impacted his Klarna board role, and also involved Victor not happy with his role in the company, fears that Sebastian be removed as CEO and him flying to US, as well as contradictory decisions from Sequoia which was in the middle of this.

this kind of telenovela plays and board politics among shareholders are normal - what’s not normal is that they were in public, making for a week of media clickbaits and PR juggling.

💡 Remember how a year ago Techstars closed down its Swedish operations without any explanations?

this week Techstars closed down ops in both Seattle and Boulder, where it had been started in 2006. Coincidence or not, Techstars founders also announced closing down their other VC op last week.

the local funding model reached its terminus because it was no longer working, they said - can’t act like a media company and live off advertising money since there’s no alignment to the business of mentoring startups.

we’ve been seeing already a transition from independent startup accelerators to the ones run by big VC houses - Sequoia, Lightspeed, GC, a16z etc. We’ll see more in the future.

it’s yet another edge play for differentiation in a hyper-competitive business, put under different labels depending on who you talk to (marketing, smart de-risking, investor value add, etc)

fact is that the only way an accelerator makes business sense and can work successfully is with a VC model.

🖖🏻 Things European minds cannot comprehend:

On most days, Apple or Microsoft alone is more valuable than the entire stock markets of major European countries. By one estimate, last year publicly traded US firms accounted for 44.9% of global market capitalization.

The most American profitable tech companies tend to be very large, usually because the software can be readily scaled, or the supply chain is difficult to replicate. Most very large global tech companies were started in the US — which is their natural Western home, given the tech regulations and market fragmentations of the EU. AI innovations may cause US tech companies to rise all the more.

Say you found a successful French AI company. Wouldn’t you prefer to be listed on the Nasdaq rather than on Paris Stock Exchange? A Nasdaq listing may make it easier to raise money, and the rest of the world will have a better understanding of the rules under which your securities are governed.

The biggest challenge to the dominance of the US equity market likely will come from China in growing sectors such as electric vehicles and solar panels. Still, China is more likely to end up as a separate, somewhat segmented set of equity markets, rather than a true global rival to the US.

all of the above from a well-argumented piece worth reading.

💰 Reddit filed to go public this week - the first social media company to IPO since Pinterest’s debut in 2019.

Sam Altman, Open AI’s CEO, has an 8.7% stake in Reddit as he has invested $60M in the company.

dude was CEO of Reddit for 8 days in 2014. In 2021, he was part of the board.

Sam is now the 3rd largest shareholder after Advance Magazines and Tencent

that holding could be worth now $435 million - not a bad investment for a startup founder, right? Not a bad one for a VC either :-) - in the investment business, just like in life, it matters who you know more than how good you are at your job. That is why VCs build networks and meet everybody and their mothers who might be useful in the future.

otoh, Reddit’s CEO in stock is worth $193 million - more than Tim Cook and Satya Nadella got paid in 2023 combined.

Americans certainly know how to pay their CEOs - any idea what’s the level at their European counterparty? Kidding :-)

as an anecdote, last week I got lectured by a college student about what Reddit is, in the context of her pitching me about her startup idea as a Reddit spinoff. It was fun.

💲 Apple vs Spotify ep s3628634

Apple started accusing Spotify of being free riders of its services, and that Spotify only wants to increase its profits, by using the EU regulations to its advantage.

I mean, they may be right - but it ain’t nothing wrong with that, Spotify follows the laws as well as the rules Apple settled for its ecosystem.

Apple conveniently didn't mention though using the ecosystem control in its favor as it is competing directly to Spotify via Apple Music, which is preinstalled on iPhones, iPads and other Apple devices.

this unusual PR move as Apple probably knows it will get a €500 million fine as a result of the EU investigation for breaking the law over competition in the streaming music market.

this after a few weeks of EU enforcing rules forcing Apple to compete on fair terms. Apple did change its operations to comply as a result, but did so by out-smarting the law, making the EU clerks look like fools.

and hey, it’s not a Spotify vs Apple fight, as we’ve got also Meta and Microsoft lobbying EU regulators against Apple’s not being an honest market player.

this will not end soon.

Apple just released a sports app, providing scores from major competitions.

I am sucker for those, it is a well designed app and it’s free. For the moment.

if it’s free, you are the product being sold, right? The app is highly integrated with Apple TV - it’s a marketing play for Apple TV’s growth (Apple started buying live sports content in addition to movies)

for context, YouTube TV is Google’s fastest-growing product, with 16 million subscribers making it one of the biggest cable TV providers.

unlike Apple though, YT doesn’t own content, it’s just an aggregator, only available in the US market.

sports streaming is big business and cord-cutters are real - ESPN will also launch its own service next year.

🤖 Google’s newly launched AI tool Gemini was temporarily put on pause as its results produced illustrations with historical inaccuracies, like racially diverse German nazis from WWII.

still early days of AI products hyped to the max and in need of fine tuning, fuelling concerns around racial bias within AI models in particular, and, in general, more worries for doomers preaching about how AI can become an existential threat to humanity.

it’s simpler than conspiracy theories though - Gemini is just a badly-tested product rushed into market because Google is behind on the LLMs front, combined with a woke culture taken to extreme and reflecting Google’s org culture, if nothing else.

what’s funny though - Google’s been doing AI for a long time, and Gemini is likely just a commercial version that’s a downgrade of the internal tools they’re using.

Maximize your credit card rewards.

Check out Kudos—recognized by CardRates as the “#1 FREE app to multiply your credit card rewards”. It’s simple, secure, and takes the hassle out of choosing the right card at checkout.

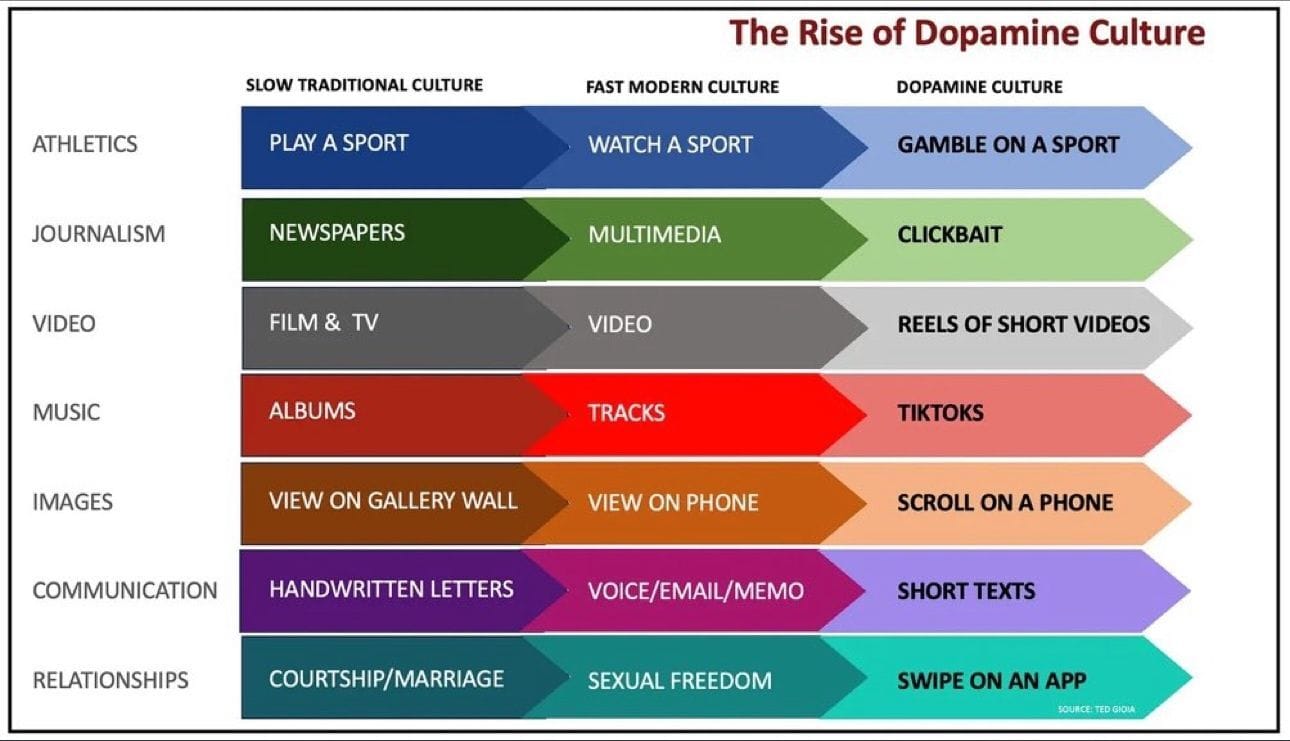

Dopamine is where it’s at

Mo’ Sundaying

Elsewhere in Europe

Liz ‘Lettuce’ Truss discovering she was not Chruchill, shockingly - a mere showcase of Brits dealing with incompetent people at the top these years.

How did Madrid become the capital of European liberalism?

- debatable - read also the comments.Capitalism vs socialism, the French edition - Paris tenants got their rental agreements cancelled in the upcoming Paris 2024 Olympic Games context.

Cars were banned from roads in Milan and eight other cities across Lombardy as a lack of rain across Italy exacerbates pollution and sparks droughts.

POV - of all the places I’ve been, the Greeks are the ones who get it … they know how to live life.

- Btw, I will be in Athens next week, drop me a line if you around and want to do coffee or something.

Reads

VC learnings after reviewing over 70 AI applied companies that have raised at least $7M

An LP guide to venture funds - the unbundling and a framework.

Traps to avoid when you do another startup.

DPI is the new IRR.

SoftBank Vision Fund dashboard.

Things I don't know about AI markets.

AI Chips:

- what they are and why they matter - link

- inside an AI Chip - link

Right now all these [AI software] startups take money from venture capital investors and give it to cloud companies and Nvidia.

The rise of fast beauty’s hyperconsumerism is driven by investors, not consumers.

More notes

Real talk:

- half of college grads are working jobs that don’t use their degrees.

- going to graduate school or making a TikTok? link

If you have to choose between being nice and kind - kind is a better option.

Memo to VCs: Soho House is uncool now, whatcha gonna do?

A look inside a nuclear submarine.

Did you find this email useful?

Thanks for reading! Please send me feedback by hitting reply.

To support the project, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered use