Hey there - welcome to a new edition of Sunday CET.

As we’re already heading into the second part of the year, this week I had a look at what VCs spent money for at seed and series A. Also - mega European industrial bets are being downsized because the market is overly saturated by the Chinese and Klarna is streamlining its ops showing signs of strategic coherence.

Thanks for reading - hit reply and let me know your thoughts and comments.

Dragos

In-depth intel you won’t find elsewhere

Nordic 9 is the best way to get familiar fast and stay updated with who’s who in the Euro VC land.

The startup deals and investors database are assorted with a library of hundreds of cheat sheets + weekly intel covering verticals, geographies and whatnot from the European startup world.

👇 Subscribe now 👇

Market talk

This week I had a quick look at the early stage deals closed in Europe this year. Some quick notes:

Seed

right at the top there is H’s 220 million round - the second year in a row when France takes the first spot at expensive seed bets in Europe, after Mistral’s 114M from 2023.

France actually has the most startups with $20 million or higher seed rounds closed this year - five - followed by the UK with three startups, and the Dutch and the Germans, each with two.

non-AI transactions include Circtec from the UK (tyres recycling), NeoCem (alt cement) from France and Monumental from the Netherlands (AGVs).

as a general observation and somehow expected given the hype and the mainstream attention, there’s more expensive AI seed rounds closed this year compared to 2023 (i.e. 20M+). Speaking of hype, Mistral is the only top seed startup from last year that already raised follow-on money to date (two, as a matter of fact - series A in October 2023 and series B in May 2024).

also notably, last year some of the more expensive non-AI deals included two gaming platforms (🇸🇪 Goals and 🇪🇸 Matchday) and two carbon removal platforms (🇬🇧 Isometric and 🇬🇧 Carbonplace). No such big bets this year though.

action is always stronger than words, and in general investors tend to say a lot of things they don’t mean. Doing seed is a hard, conviction-based exercise and it’s always fun to see the reflection of the investors action visavis their talk, the actual paradigm shifts and market opportunities - other seed deals that caught my eyes from this year’s batch include 🇫🇷 Cure51 (cancer data analytics), 🇬🇧 Monumono (next gen EV engines), 🇸🇪 Fever (smart grid marketplace), 🇬🇧 Lawhive (legal marketplace), 🇬🇧 Sava (health wearables) or 🇬🇧 Unify.

Series A

at series A, it’s gotta be 🇫🇷 Poolside, with a rumoured 400 million round co-led by Bain Capital and DST Global.

fun fact - Poolside is actually a software startup co-founded by an American VC and a Dutch tech guy who relocated from USA to France last year, as they were heavily seeded by local investors. It’s easier to raise capital as an American in Europe, I guess.

also notably, those projects may be expensive transactions dubbed series A but they aren’t growing at associated series A paces - their high valuations are due to the capital intensive nature of what they do, as opposed to presenting significant business traction that a respectable series A investor would judge a project by.

that’s likely the case for the SAAS startups further down the batch, where the higher end is topped by 🇩🇪 Markt Pilot (automotive) with a 43 million series A round, followed by deals at the 30-40M level including 🇬🇧 Praktika (education), 🇹🇷 Midas (financial services), 🇩🇰 Getwhy (UX research) or 🇬🇧 Lapse (social network).

🇪🇺 Covid remains:

Getir announced closing almost entirely and scaling down to a local operation active in Turkey only.

still raised some 250 million for cleaning up the mess, and split the local business in two after a reported power struggle between Mubadala, which gets to keep the retail op, and Getir's co-founder/CEO Nazim Salur, who gets to keep the non-retail side of it.

meanwhile in Central Europe, another VC darling, Rohlik, announced raising 170 million in debt and equity, signalling that it is still in business struggling to provide investors returns.

some numbers they pushed to the media caught my eyes:

last year Rohlik made less than 1 billion in sales out of 800k customers

that’s compared to revenues of 300M and 750k customers in 2020, out of a similarly-sized 17k SKUs pool.

that’d be 50k more customers in three years for a VC-backed consumer business - basically in three years they managed to 3X the money out of the same type of inventory, sold to a somewhat similar number of customers, based in the same three countries. Where does that extra money come from?

hard to believe they squeezed more bucks per customer out of groceries sold to price sensitive countries (CZ, Austria, Germany) - it’s likely that the growth comes from outside the core retail business, probably some sort of a B2B op leveraging the logistics infra, which weighs a lot on the balance sheet, and can make a difference in retail.

if my assumption is correct, then Rohlik has pivoted from a business with a stagnating consumer side into a b2b operation in the past three years.

also notably a good chunk of the above 170 million is provided by EBRD and the EU, institutions not focused on revenue growth like VCs are but rather caring about jobs creation - an important nuance when you sell financial products.

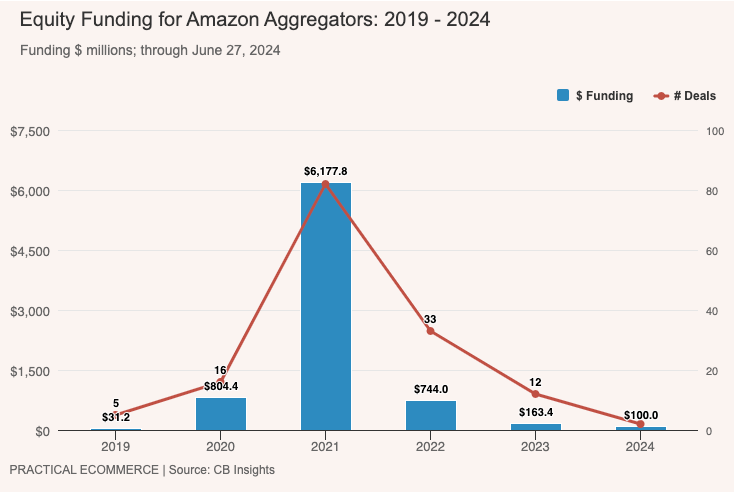

anyways, that’s just me being picky on a sunny Saturday morning. I am old enough to remember a viral investment memo circulated by tier 1 investors on social media back in 2021 and claiming that 15 minutes ecommerce is the next massive paradigm theme everybody and their mother should put money into in Europe. The money was spent, indeed.

PS: here’s another VC Covid theme in numbers:

🇪🇺 BMW cancelled a €2 billion Northvolt contract, as the Swedes are two years behind the schedule to deliver EV battery cells agreed with BMW in 2020. Northvolt also cancelled plans to build its fourth factory in Sweden.

putting aside the factory assembling challenges, execution of which the Swedes likely lost business for, this has seemingly an important macro component - Northvolt is not the only battery producer re-evaluating its entire line of business in Europe. ACC, a JV established in 2020 by Stellantis, Mercedes-Benz, and TotalEnergies, have also put on halt its plans to build factories in Germany and Italy and is re-evaluating its future direction.

that is because the market is saturated, with already more than twice as much lithium-ion battery capacity than needed.

btw, China controls more than 80% of the market and is leading on costs by a wide margin.

on top of the Chinese over capacity, Northvolt and ACC are facing consequences of a larger trend of lagging EVs sales demand, combined with the European war against Chinese cheap cars that invaded the local market.

over-supply, unit economics, subsidies, global demand - those are risk examples of capital intensive businesses → building factories down the EV manufacturing supply chain is not only hard, but also requires huge capex expenditure and long market cycles that need to be calibrated to other parts of the supply chain all the way up to the consumer market.

is the EV a new car paradigm worth betting on? Undoubtedly - but overnight success takes more than 10 years, and history shows that industrial shifts happen in decades, rather than, say, within the 5-8 years risk cycle a professional investor is usually willing to take.

Northvolt’s case is just a little piece of an open ended question about where Europe fits into this current industrial revolution and how it is (not) able to compete on a global scale against China and the US.

🇸🇪 Klarna offloaded its Checkout unit to private Swedish investors led by a local shop called BLQ Invest in a 500M deal that includes 300M in expected rev-share earnouts.

that marks the company’s focus entirely on the consumer business and the strategic objective of not competing directly with Klarna’s distributors.

it is also a reminder that implementation beats strategy - Klarna’s been selling checkout SAAS for 12 years, ever since Stripe was two and had no business in Europe (now it’s a juggernaut, alongside Adyen). In more than a decade, Klarna’s checkout product has only produced significant business in the Nordics.

if you’re in for taking Klarna’s pulse, their CEO provides some context here (skip to min 33).

Presented by

Intercom for Startups

Join Intercom’s Early Stage Program to receive a 90% discount.

Get a direct line to your customers. Try the only complete AI-first customer service solution.

Also notable

Recommended newsletter

The best investors in Europe rely on a PRO newsletter covering long tail deal flow, strategic moves, new funds, exits - essential intel and insightful coverage with what matters in Europe. Start receiving the weekly newsletter here.

More Sunday-ing

🇮🇸 Iceland sold this week a €50 million gender bond, a kind of debt that funds projects to promote women’s empowerment.

🇩🇰 Denmark started a number of unconventional initiatives to make animal-free meals more enticing, tastier and accessible for consumers.

🍦 Founders after they sold their business for 300 million to Unilever:

“They [Unilever] don’t understand it, they don’t really know how to deal with it and they want to run it like any other brand that they own.”

💲 Philippe Laffont on AI darlings and opportunities in today’s markets.

🏭 Fabrice Grinda on a rather long but interesting discussion on macro, crypto and venture capital.

🦾 John Gruber on Apple Intelligence.

📝 Tim O’Reilly on how to fix AI’s original sin, stealing copyright content that is.

🇨🇳 The biggest change in China's primary venture capital market in the past year is that it no longer exists.

🤖 VC work replaced by robots - instead of a few VC analysts doing the grunt work for a partner who is out befriending founders and leading investments, now a robot does the grunt work and the partner does the deals and makes more money.

🇪🇺 Cultural factoids: US VCs are on the first overnite red-eye flight to Europe, whilst the Local VCs are busy deciding which Private Members Club they’d like to host the founder at to ask stupid questions - not un-true but while they’re naturally part of the European charm, those anecdotes are rather outliers that make for engaging social media content.

☕ Spending $250,000 to open a NYC cafe that brings in $50M per year.

👞 Wall Street shoeshiners embrace cleaning sneakers to survive.

🆘 The times we live in, the US presidential debate edition:

That’s all folks, have a wonderful week!

Did you find this email useful?

Thanks for reading! Please send me feedback by hitting reply.

To support my work, upgrade to one of the subscription options.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.4